Sample Pages

Contents List

-

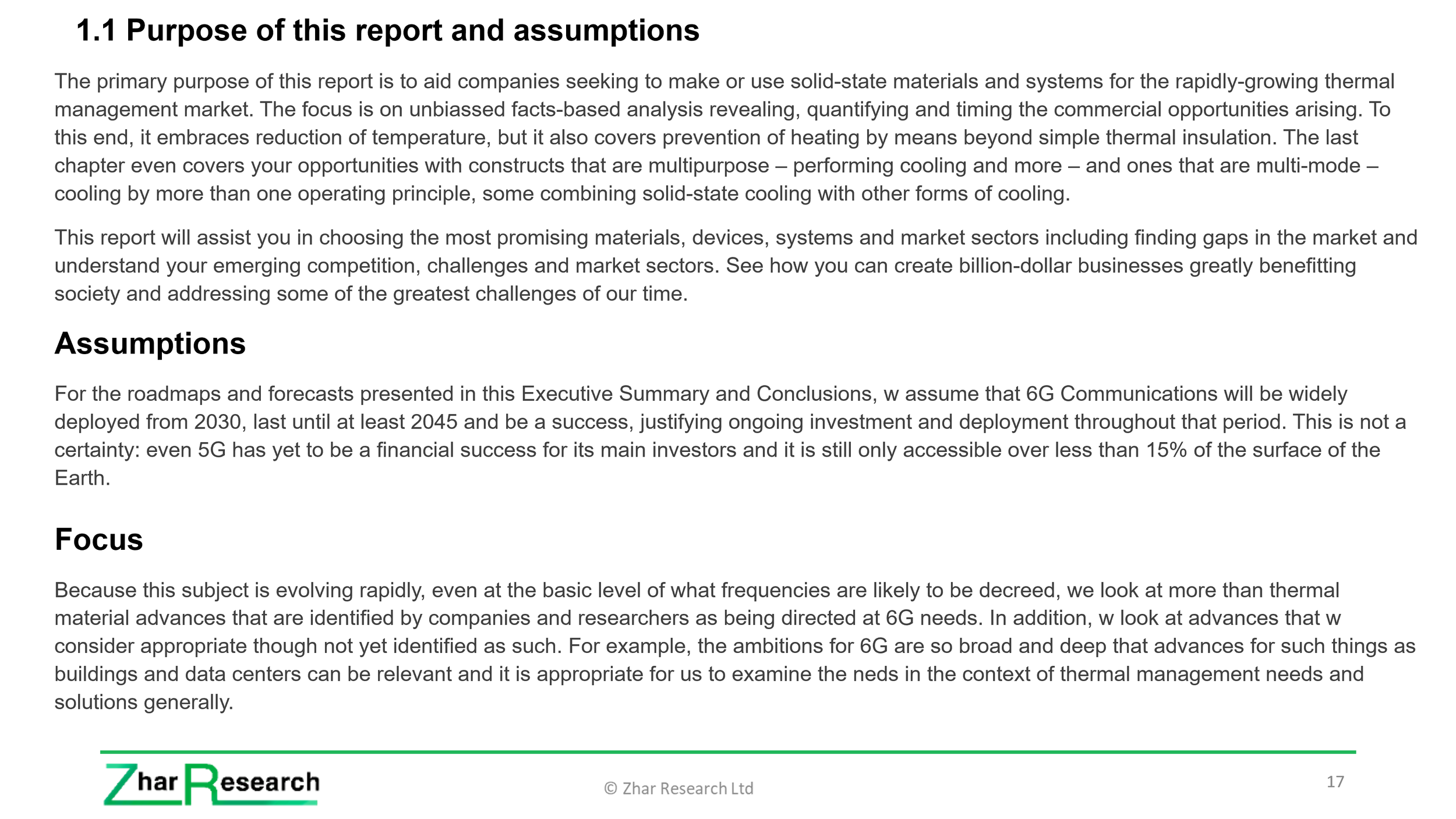

1.1 Purpose of this report and assumptions

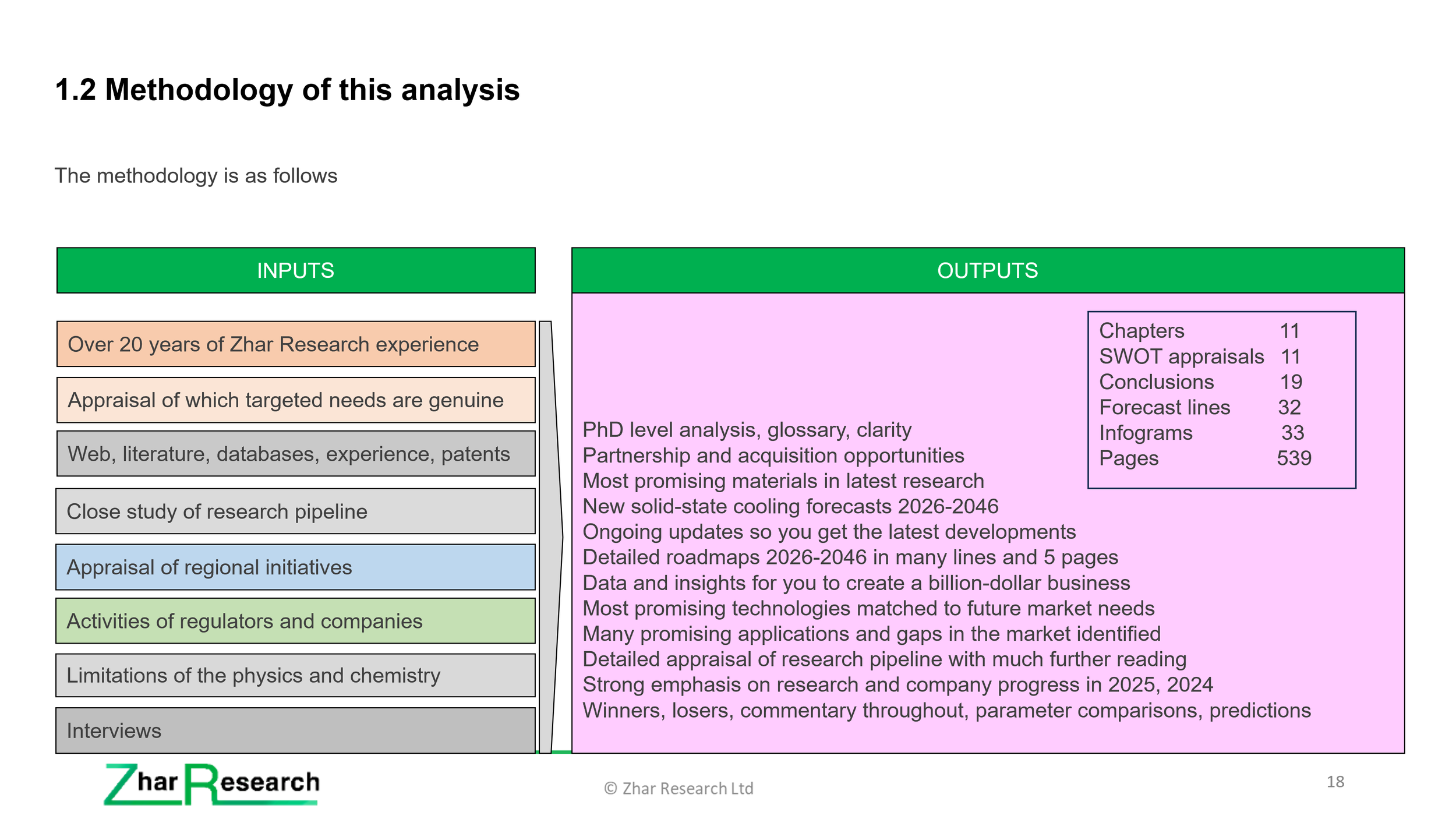

1.2 Methodology of this analysis

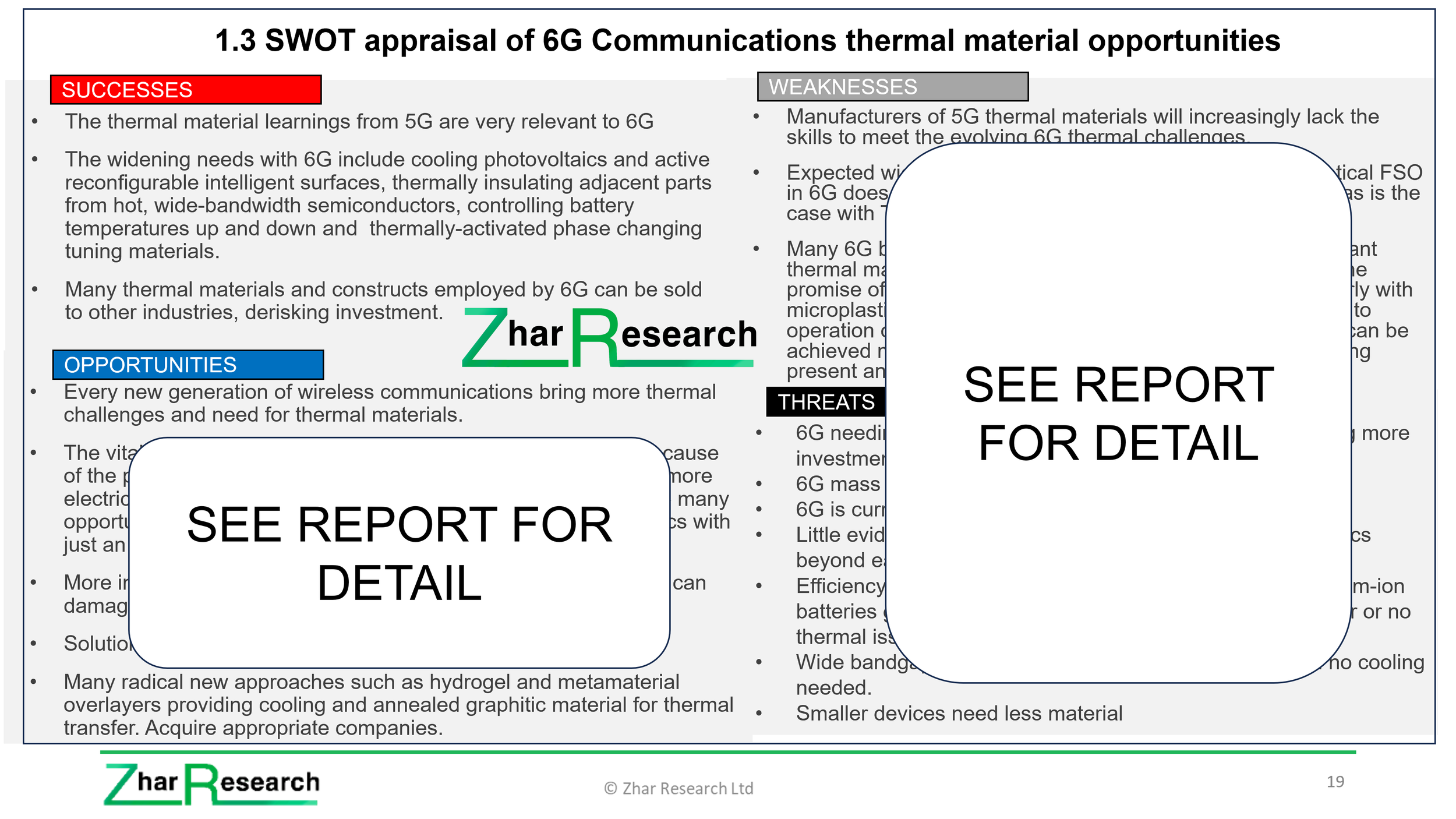

1.3 SWOT appraisal of 6G Communications thermal material opportunities

1.4 Some reasons for the escalating need for cooling

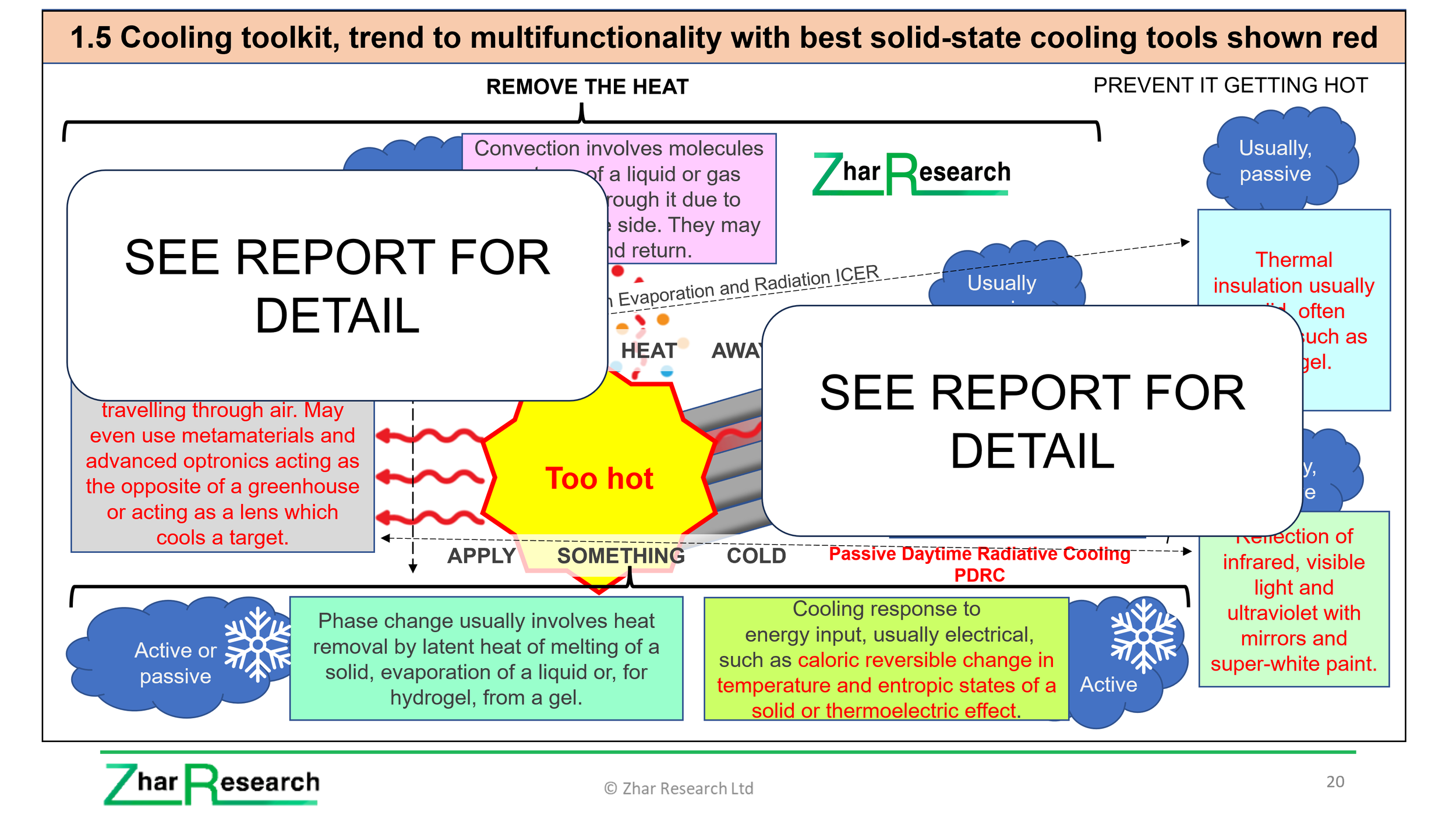

1.5 Cooling toolkit, trend to multifunctionality with best solid-state cooling tools shown red

1.6 The nature of solid-state cooling and why it is now a priority for 6G and generally

1.7 Primary conclusions: 6G thermal requirements

1.8 Primary conclusions: Materials for making cold in 6G infrastructure and client devices

1.8.1 General situation

1.8.2 Leading candidate materials and structures compared

1.8.3 Leading materials in number of latest research advances on solid state cooling

1.8.4 Research pipeline of solid-state cooling by topic vs technology readiness level

1.8.5 Typical best reported temperature drop achieved by technology 2000-2046 extrapolated

1.8.6 SWOT appraisal of Passive Daytime Radiative Cooling PDRC and pie chart of leading materials

1.8.7 SWOT appraisal of electrocaloric cooling and pie chart of leading materials

1.8.8 SWOT appraisal of elastocaloric cooling and leading materials

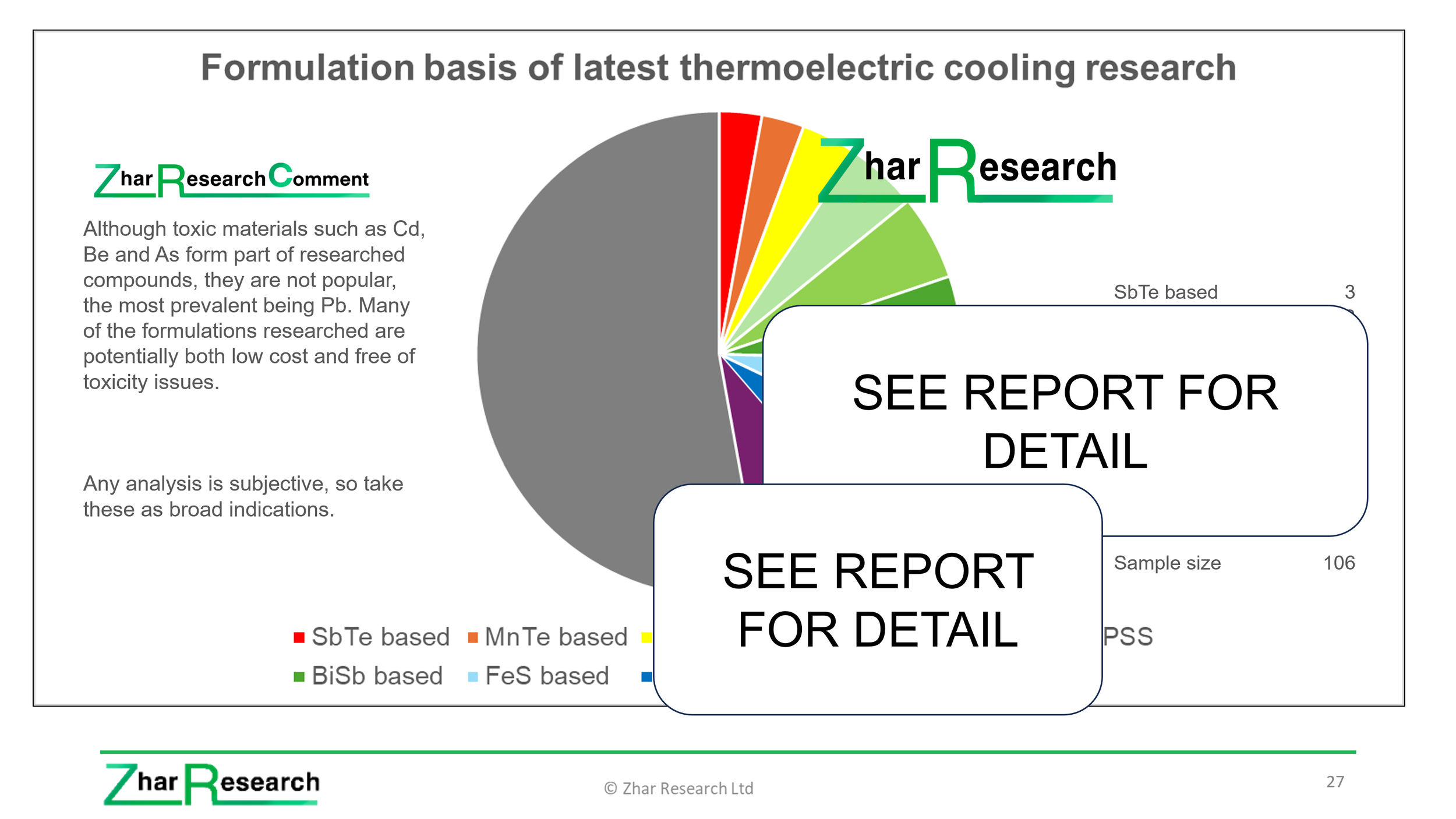

1.8.9 SWOT appraisal of thermoelectric cooling and pie chart of leading materials

1.9 Primary conclusions: Materials for removing heat by conduction and convection

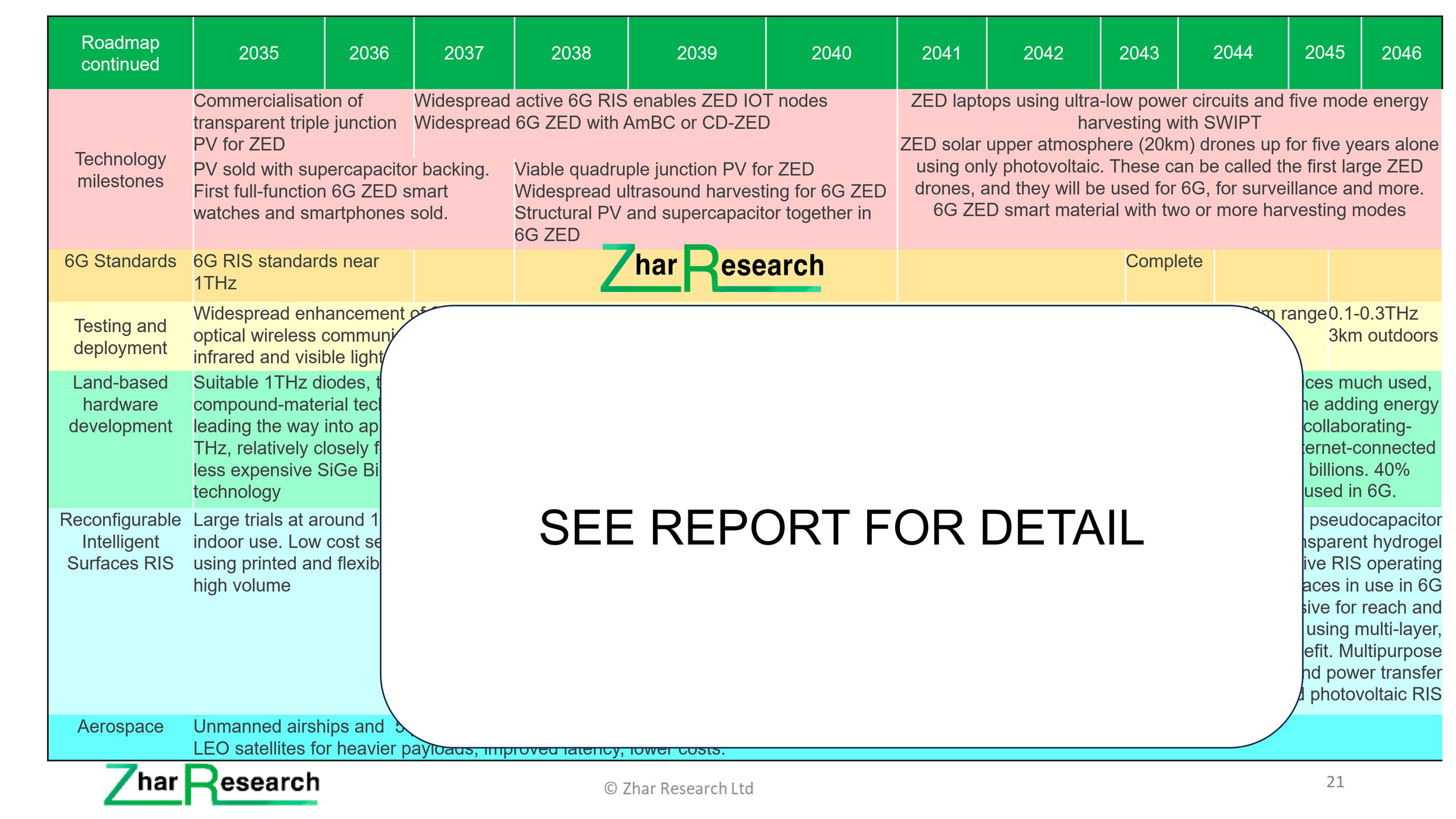

1.10 Roadmaps of 6G materials and hardware and separately cooling 2026-2046

1.11 Market forecasts in 32 lines 2026-2046

1.11.1 Thermal management material and structure for 6G infrastructure and client devices $ billion 2026-2046

1.11.2 Dielectric and thermal materials for 6G value market % by location 2029-2046

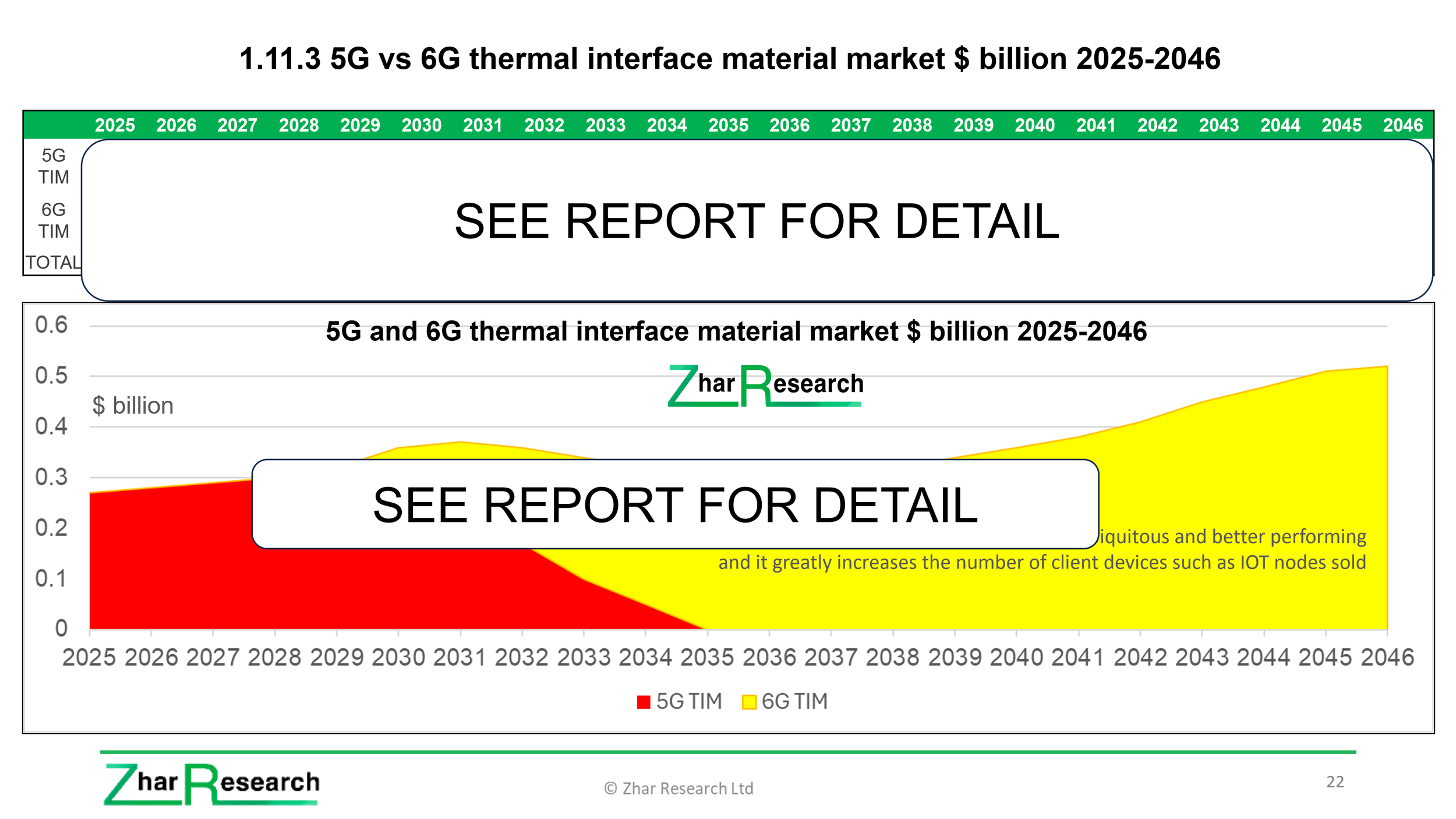

1.11.3 5G vs 6G thermal interface material market $ billion 2025-2046

1.12 Background forecasts 2025-2046

1.12.1 Cooling module global market by seven technologies $ billion 2025-2046

1.12.2 Terrestrial radiative cooling performance in commercial products W/sq. m 2025-2046

1.12.3 Market for 6G vs 5G base stations units millions yearly 2025-2046

1.12.4 Market for 6G base stations market value $bn if successful 2025-2046

1.12.5 6G RIS value market $ billion: active and three semi-passive categories 2029-2046

1.12.6 6G fully passive transparent metamaterial reflect-array market $ billion 2029-2046

1.12.7 Smartphone billion units sold globally 2023-2046 if 6G is successful

1.12.8 Air conditioner value market $ billion 2025-2046

1.12.9 Global market for HVAC, refrigerators, freezers, other cooling $ billion 2025-2046

1.12.10 Refrigerator and freezer value market $ billion 2025-2046

1.12.11 Stationary battery market $ billion and cooling needs 2025-2046

-

2.1 Overview

2.1.1 Why 6G brings a much bigger opportunity for thermal management and it is mainly cooling

2.1.2 6G cooling challenge in context of evolution of other cooling increasingly becoming laminar and solid state

2.1.3 Need for cooling in general becomes much larger and often different in nature: the 6G smartphone example

2.1.4 Some of the reasons for much greater need for thermal materials in 6G

2.1.5 How cooling technology will trend to smart materials 2025-2046

2.2 Location of the primary 6G thermal management opportunities

2.2.1 Situation with primary 6G infrastructure and client devices

2.2.2 Example RIS for massive MIMO base station: Tsinghua University, Emerson

2.3 Cooling, heat barrier and advanced thermally supportive technologies for 6G covered in this report

2.4 Examples

2.4.1 Severe new microchip cooling requirements arriving

2.4.2 Cooling 6G electronic components and smartphones

2.4.3 Cooling 6G base stations including their energy harvesting and storage

2.4.4 Cooling solar panels and photovoltaic cladding for 6G infrastructure

2.4.5 Large battery thermal management for 6G infrastructure

2.4.6 Examples of advances in 2024-5

2.5 Twelve solid-state cooling operating principles compared by 10 capabilities

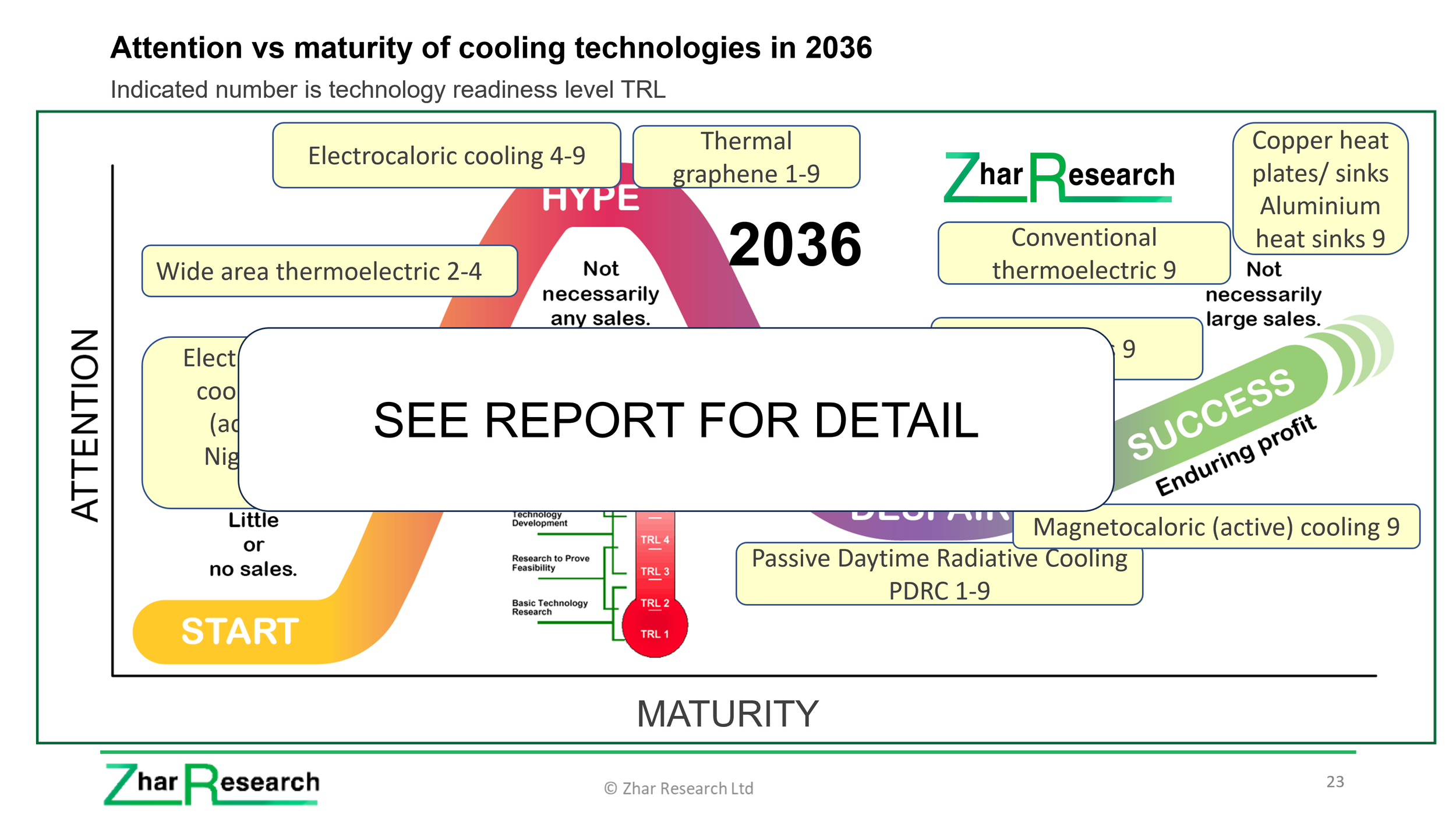

2.6 Attention vs maturity of cooling and thermal control technologies 3 curves 2026, 2036, 2046

2.7 Comparison of traditional and emerging refrigeration technologies

2.8 Undesirable materials widely used and proposed: this is an opportunity for you

-

3.1 Overview

3.2 PDRC basics

3.3 Radiative cooling materials by structure and formulation with research analysis

3.4 Potential benefits and applications

3.4.1 Overall opportunity and progress

3.4.2 Transparent PDRC for facades, solar panels and windows including 8 advances in 2024

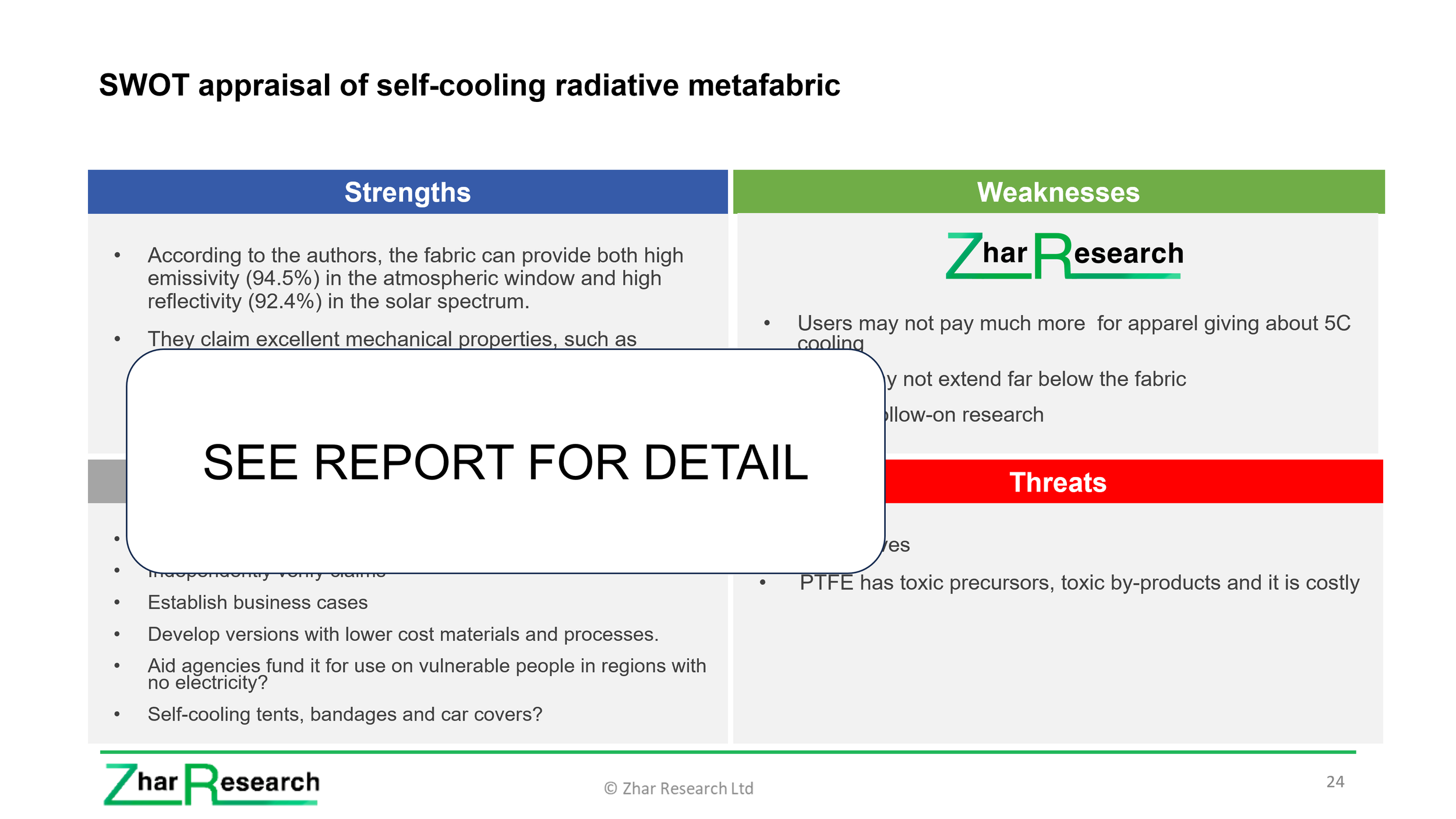

3.4.3 Wearable PDRC, textile and fabric with 15 advances in 2024-5 and SWOT

3.4.4 PDRC cold side boosting power of thermoelectric generators

3.4.5 Color without compromise

3.4.6 Aerogel and porous material approaches

3.4.7 Environmental and inexpensive PDRC materials development

3.5 Other important advances in 2025 and earlier

3.5.1 40 important advances in 2024-5

3.5.2 Advances in 2023

3.6 Companies commercialising PDRC

3.6.1 3M USA

3.6.2 BASF Germany

3.6.3 i2Cool USA

3.6.4 LifeLabs USA

3.6.5 Plasmonics USA

3.6.6 Radicool Japan, Malaysia etc.

3.6.7 SkyCool Systems USA

3.6.8 SolCold Israel

3.6.9 Spinoff from University of Massachusetts Amherst USA

3.6.10 SRI USA

3.7 PDRC SWOT report

-

4.1 Overview of the bigger picture with SWOT

4.2 Maturity curve of radiative cooling technologies

4.3 Self-adaptive and switchable radiative cooling

4.3.1 The vanadium phase change approaches

4.3.2 Alternative using liquid crystal

4.4 Tuned radiative cooling using both sides: Janus emitter JET advances and SWOT

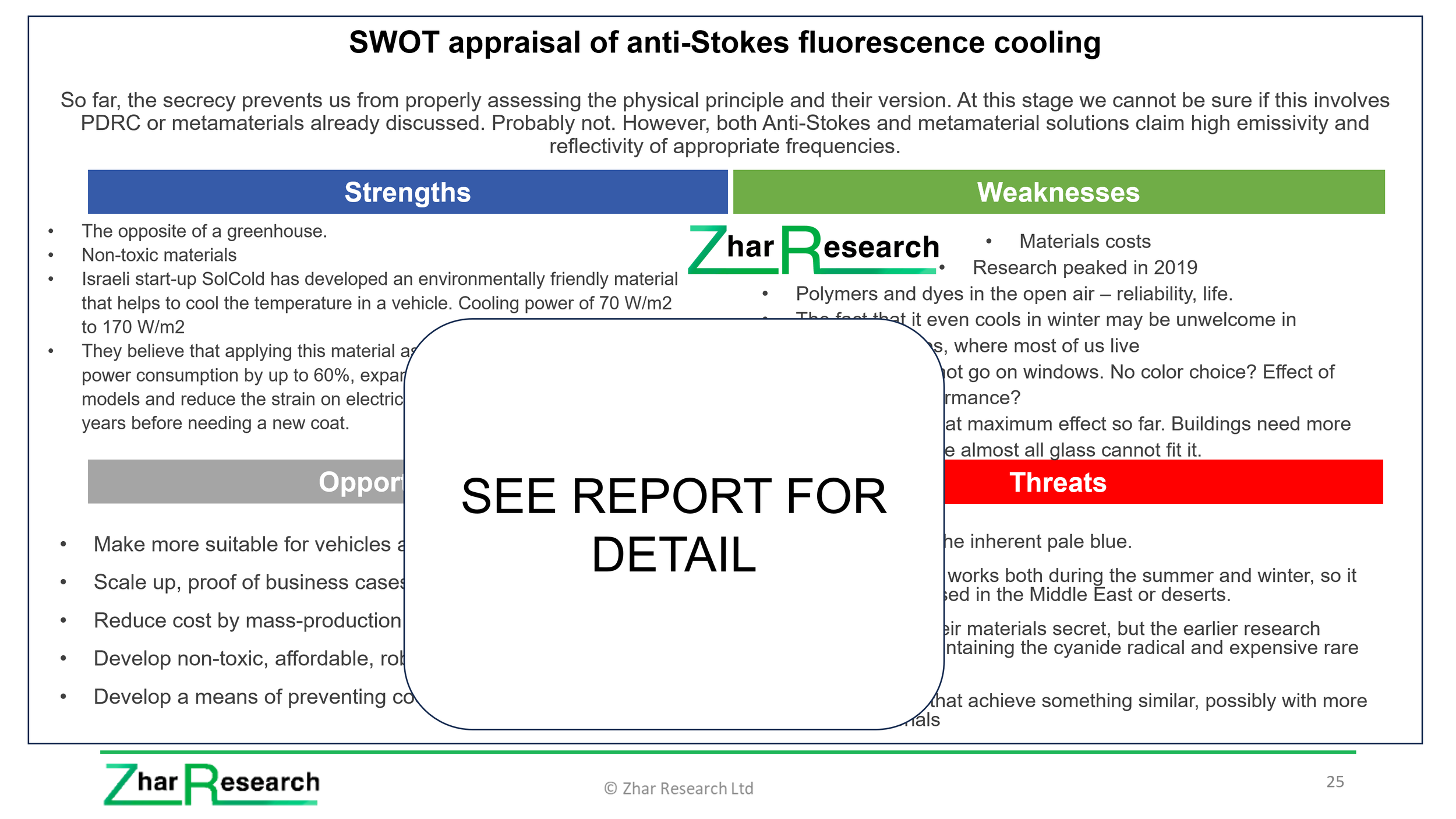

4.5 Anti-Stokes fluorescence cooling with SWOT appraisal

-

5.1 Structural and ferroic phase change cooling modes and materials

5.2 Solid-state phase-change cooling potentially competing with other forms in named applications

5.3 The physical principles adjoining caloric cooling

5.4 Operating principles for caloric cooling

5.5 Caloric compared to thermoelectric cooling and winning caloric technologies identified

5.6 Some proposals for work to advance the use of caloric cooling

5.7 Electrocaloric cooling

5.7.1 Overview and SWOT appraisal

5.7.2 Operating principles, device construction, successful materials and form factors

5.7.3 Electrocaloric material popularity in latest research with explanation

5.7.4 Giant electrocaloric effect

5.7.5 Electrocaloric cooling: issues to address

5.7.6 10 important advances in 2025

5.7.7 58 earlier advances

5.8 Magnetocaloric cooling with SWOT appraisal

5.9 Mechanocaloric cooling (elastocaloric, barocaloric, twistocaloric) cooling

5.9.1 Elastocaloric cooling overview: operating principle, system design, applications, SWOT

5.9.2 Elastocaloric advances in 2024-5

5.9.3 Barocaloric cooling

5.10 Multicaloric cooling advances in 2025

-

6.1 Metamaterials 6.1.1 Metamaterial and metasurface basics and thermal metamaterial advances in 2025

6.1.2 The meta-atom, patterning and functional options

6.1.3 SWOT assessment for metamaterials and metasurfaces generally

6.1.4 Metamaterial energy harvesting may power 6G active cooling

6.1.5 Thermal metamaterial with 14 advances in 2025 and 2024

6.2 Advanced photonic cooling and prevention of heating

-

7.1 Basics

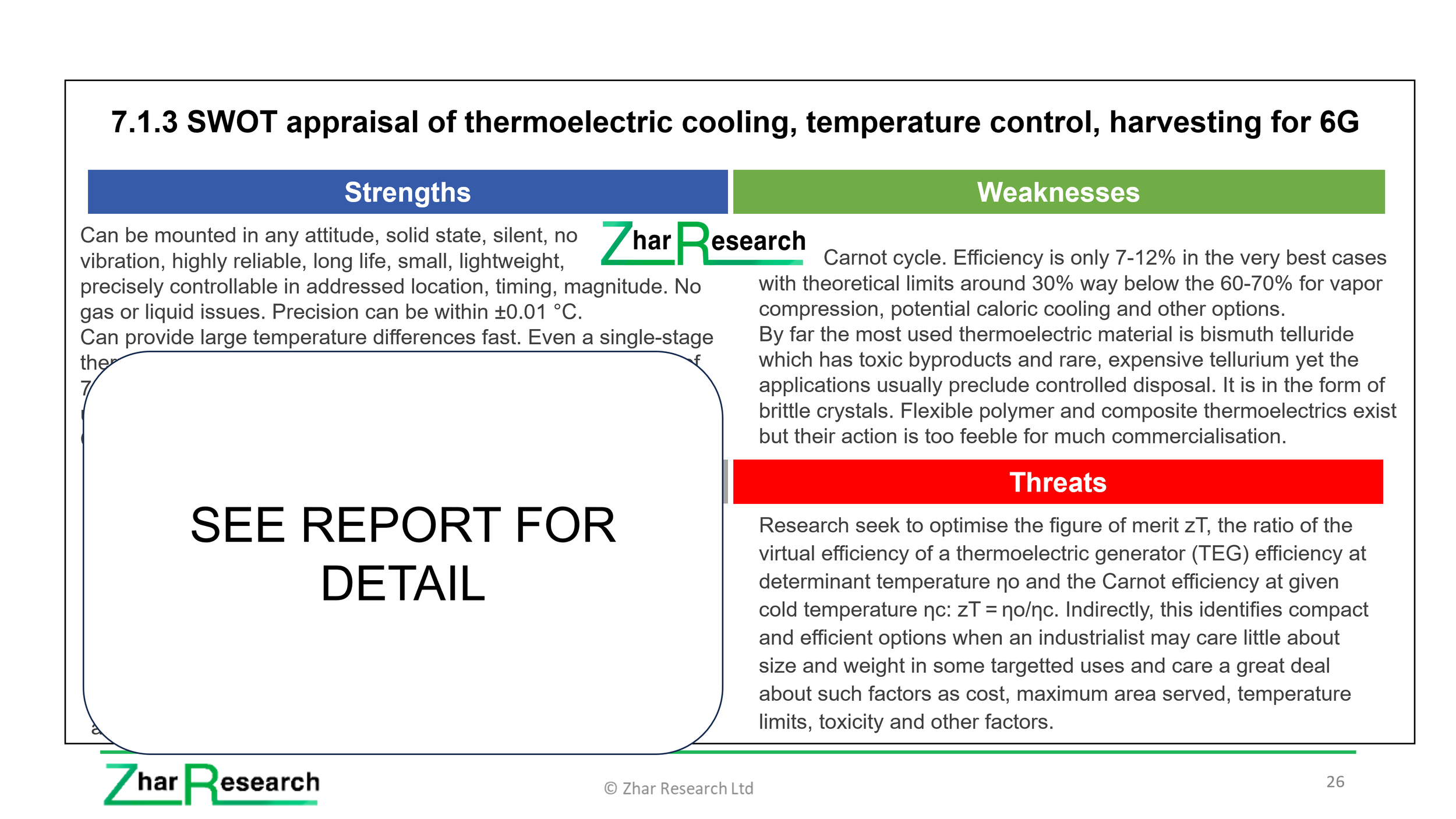

7.1.1 Operation, examples, SWOT appraisal

7.1.2 Thermoelectric cooling and temperature control applications 2026 and 2046

7.1.3 SWOT appraisal of thermoelectric cooling, temperature control, harvesting for 6G

7.2 Thermoelectric materials

7.2.1 Requirements

7.2.2 Useful and misleading metrics

7.2.3 Quest for better zT performance which is often the wrong approach

7.2.4 Some alternatives to bismuth telluride being considered

7.2.5 Non-toxic and less toxic thermoelectric materials, some lower cost

7.2.6 Ferron and spin driven thermoelectrics

7.3 Wide area and flexible thermoelectric cooling is a gap in the market for you to address

7.3.1 The need and general approaches

7.3.2 Advances in flexible and wide area thermoelectric cooling in 2025 and earlier

7.3.3 Wide area or flexible TEG research 40 examples that may lead to similar TEC

7.4 Radiation cooling of buildings: multifunctional with thermoelectric harvesting

7.5 The heat removal problem of TEC and TEG – evolving solutions

7.6 20 advances in thermoelectric cooling and harvesting involving cooling and a review

7.7 Earlier advances

7.8 82 Manufactures of Peltier thermoelectric modules and products

-

8.1 Overview: 6G smartphone vapor cooling and hydrogel cooling for 6G

8.2 Background to phase change cooling

8.3 Heat pipes and vapor chambers

8.3.1 Definitions and relevance to 6G infrastructure and client devices

8.3.2 Focus of vapor chamber research relevant to 6G success

8.3.3 Research on relevant heat pipes, vapor chambers and allied: 39 advances

8.3.4 Thermal storage heat pipes: nano-enhanced phase change material (NEPCM) for device thermal management

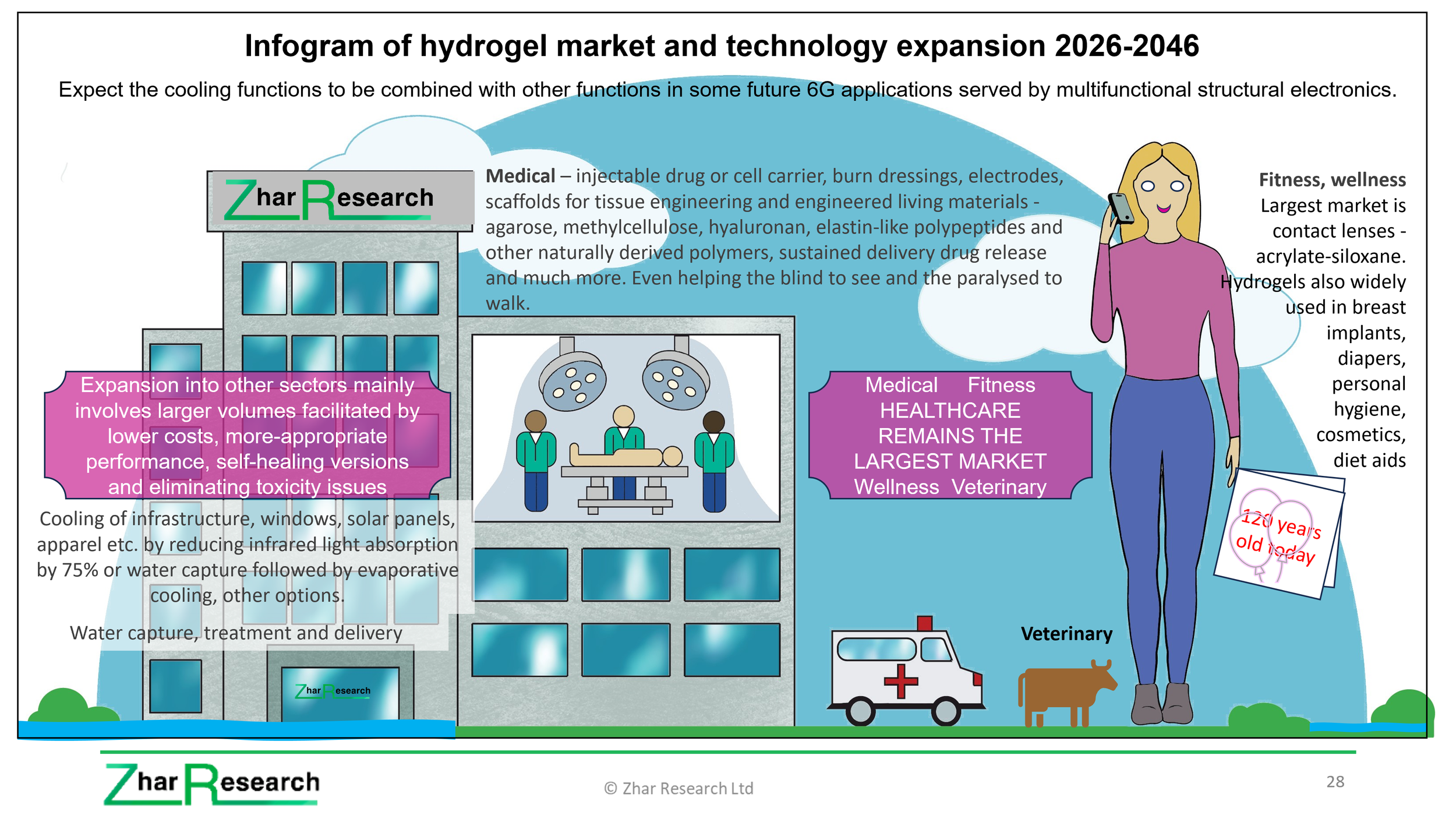

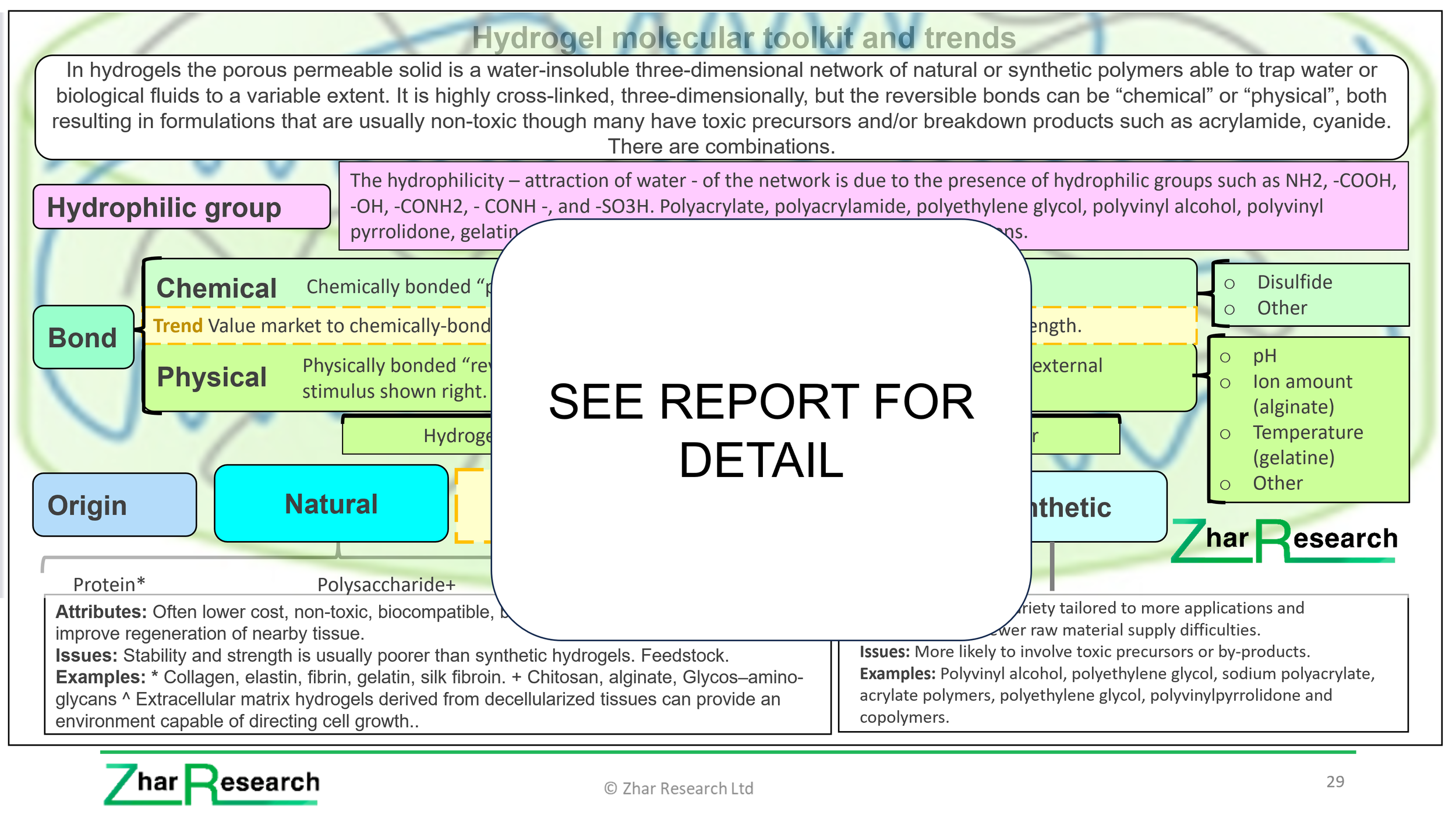

8.4 Hydrogels for 6G Communications

8.4.1 Thermal hydrogels: context, ambitions and limitations

8.4.2 Hydrogels cooling suitable for 6G microelectronics and solar panels: Five advances

8.4.3 Thermogalvanic hydrogel for synchronous evaporative cooling

8.4.4 Hydrogels in architectural cooling that can involve 6G functions: advances

8.4.5 Aerogel and hydrogel together for cooling

8.4.6 Other emerging cooling hydrogels for 6G microchips, power electronics, data centers, large batteries, cell towers and buildings

-

9.1 Overview: thermal adhesives to thermally conductive concrete for 6G

9.1.1 TIM, heat spreaders from micro to heavy industrial: activity of 17 companies

9.1.2 17 examples of research advances in 2025 and 2024 relevant to 6G transistors up to buildings

9.1.3 Annealed pyrolytic graphite: progress in 2025 and 2024 as microelectronic TIM

9.1.4 Thermally conductive concrete and allied work

9.2 Important considerations when solving thermal challenges with conductive materials

9.2.1 Bonding or non-bonding

9.2.2 Varying heat

9.2.3 Electrically conductive or not

9.2.4 Placement

9.2.5 Environmental attack

9.2.6 Choosing a thermal structure

9.2.7 Research on embedded cooling

9.3 Thermal Interface Material TIM

9.3.1 General

9.3.2 Seven current options compared against nine parameters

9.3.3 Nine important research advances in 2025 and 2024 relevant to 6G

9.3.4 Thermal pastes compared

9.3.5 TIM and other examples today: Henkel, Momentive, ShinEtsu, Sekisui, Fujitsu, Suzhou Dasen

9.3.6 37 examples of TIM manufacturers

9.3.7 Thermal interface material trends as needs change: graphene, liquid metals etc.

9.4 Polymer choices: silicones or carbon-based

9.4.1 Comparison

9.4.2 Silicone parameters, ShinEtsu, patents

9.4.3 SWOT appraisal for silicone thermal conduction materials

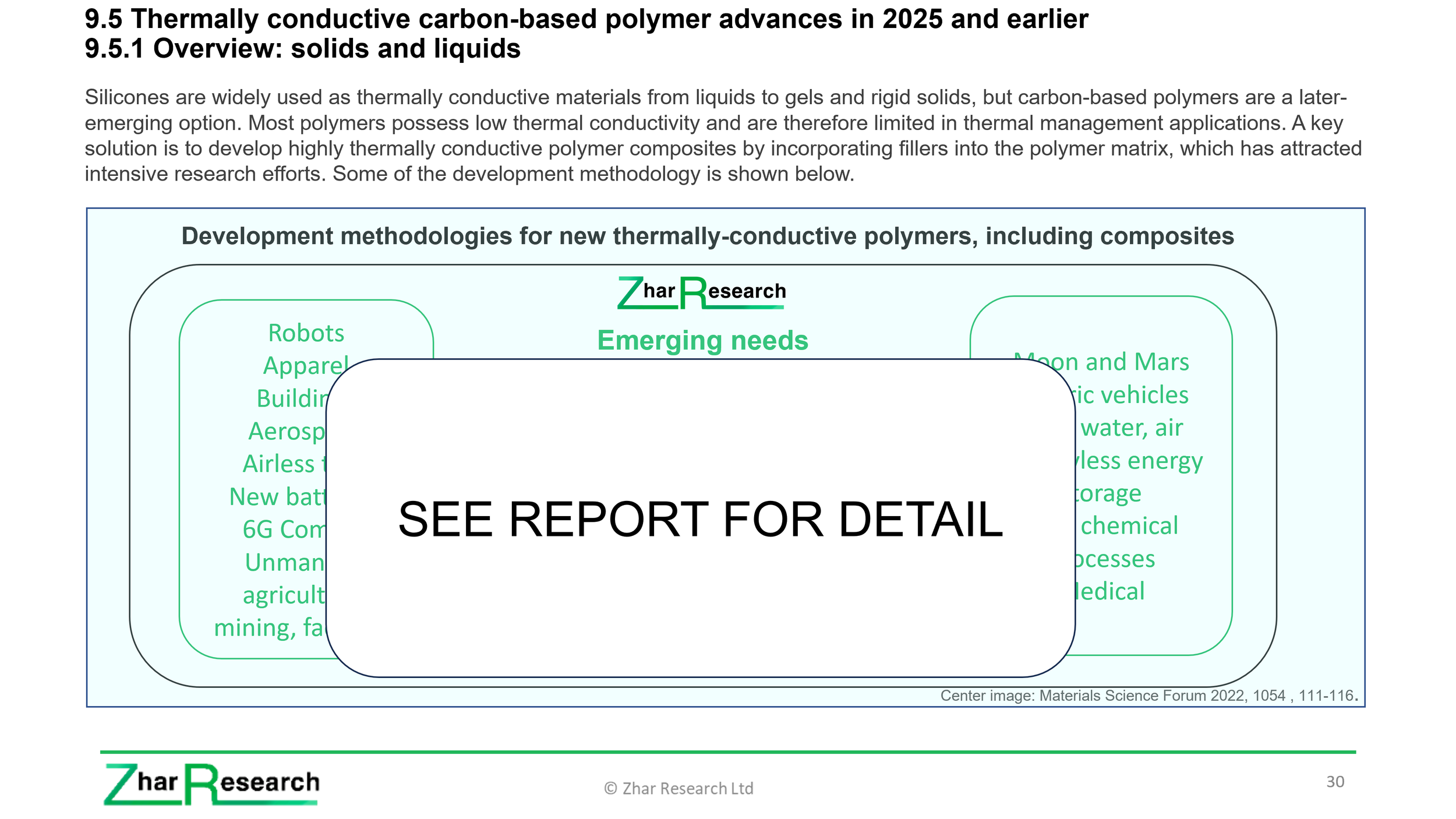

9.5 Thermally conductive polymer advances in 2025 and earlier

9.5.1 Overview

9.5.2 Examples of companies making thermally conductive additives

9.5.3 Thermally conductive polymers: pie charts of host materials and particulates prioritised in research

9.5.4 Important progress in 2025 and earlier

-

10.1 Overview

10.2 Inorganic, organic and composite thermal insulation for 6G

10.3 Heat shield film and multipurpose thermally insulating windows

10.4 Thermal insulation for heat spreaders and other passive cooling

10.4.1 W.L.Gore enhancing graphite heat spreader performance

10.4.2 Protecting smartphones from heat

10.4.3 20 companies involved in silica aerogel thermal insulation of devices

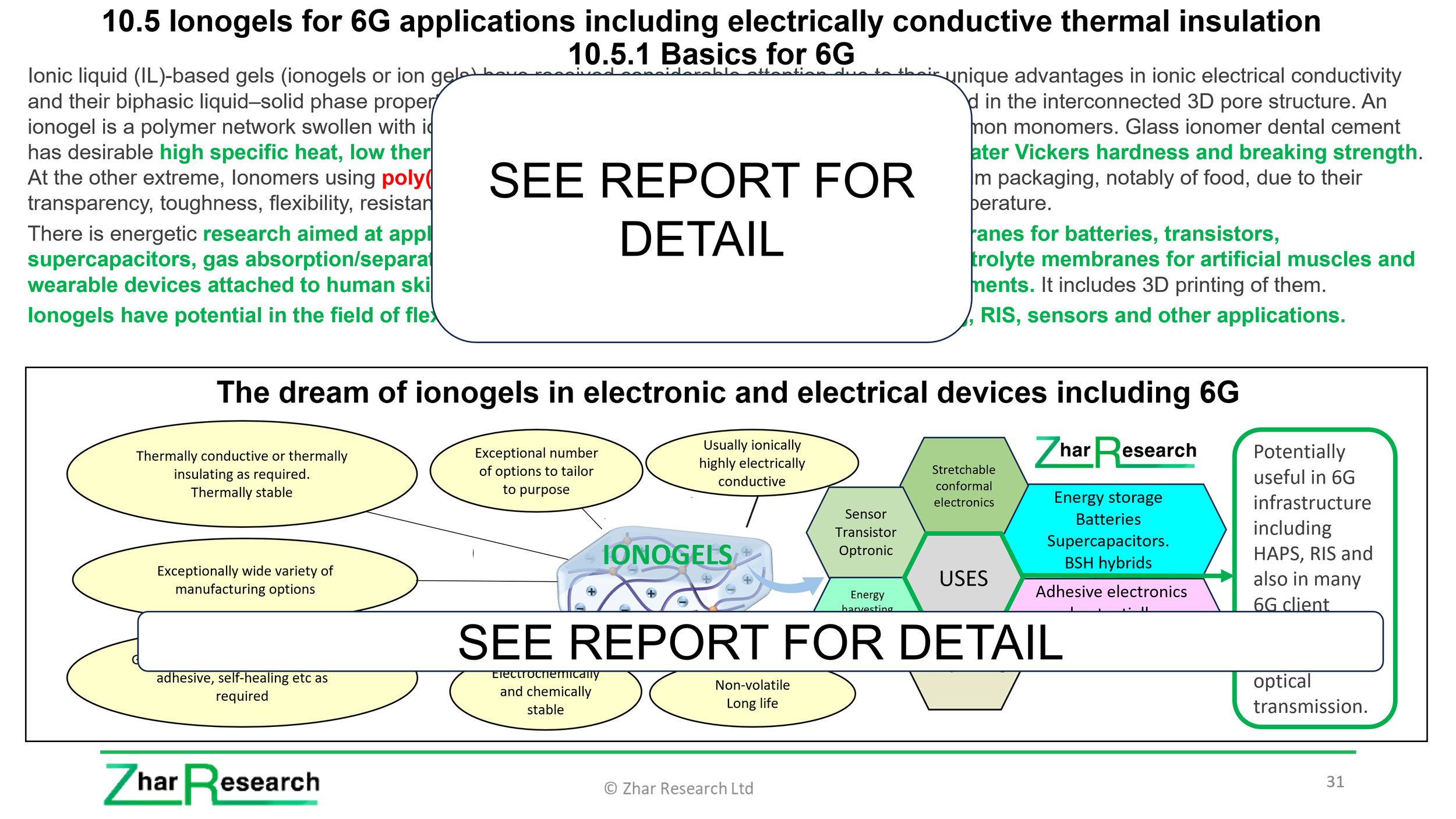

10.5 Ionogels for 6G applications including electrically conductive thermal insulation

10.5.1 Basics for 6G

10.5.2 Eight ionogel advances in 2025 and 2024

-

11.1 Purpose of this chapter

11.1.1 General

11.1.2 Types of metamaterial thermal management materials by function

11.1.3 Applications analysed from sensors to surgical robots and spacecraft

11.1.4 Three families of metamaterials overlap

1.2 Thermal metamaterials

11.2.1 Some of the drivers of commercialisation of thermal metamaterials

11.2.2 Cooling toolkit, 7 metamaterial-enabled options in blue text, trend to multifunctionality

11.2.3 Examples of thermal metamaterials in 2025 advances

11.3 Primary conclusions; market positioning

11.4 Primary conclusions: leading formulations, functionality and manufacturing technologies

11.5 Popularity by formulation in 132 examples of latest thermal metamaterial research

11.6 Static to dynamic heat transfer using metamaterials

11.7 Static radiative cooling materials showing metamaterials as one of many options

11.8 Thermal metamaterial and cooling roadmap by market and by technology 2025-2045

11.9 Thermal meta-device market $ billion 2025-2045 by application segment

11.10 Electromagnetic meta-device market $ billion 2025-2045

11.11 Electromagnetic meta-device market $ billion 2025-2045 by application segment

11.12 Meta-device market electromagnetic vs thermal 2025-2045

How can we deal with the increasing problems of thermal management with every new generation of wireless communications? We get ever more infrastructure generating more heat and more compact client devices offering less space for thermal management. The new 533-page, commercially-oriented Zhar Research report, “6G Communications Thermal Materials for Infrastructure and Client Devices: Opportunities, Markets, Technology 2026-2046” has the answers and forecasts the large market, mainly for new cooling materials, that will emerge.

Incremental then disruptive

Dr Peter Harrop, CEO of Zhar Research, puts it this way. “Initially, 6G will be an incremental improvement mainly using, and limited by, 5G frequencies and largely served by improved 5G thermal solutions. Ubiquity is a top priority for 6G. No more patchy coverage in cities from London to Tokyo and dead in the countryside and ocean. Much more self-powering, thermally managed, will avoid the considerable cost of running power to expanding terrestrial infrastructure and the impossibility of running power to burgeoning aerospace infrastructure for 6G. However, 6G Phase Two, around 2035, must be a whole new ball game to achieve real financial success with startlingly better performance and reach. That means disruptive new thermal solutions for everything from active, transparent, 360-degree reconfigurable intelligent surfaces to reinvented, “must have” personal electronics.”

Detailed analysis required beyond 6G, with latest research prioritised

He points out that, to meet the thermal challenges, including in more compact client devices in huge numbers, such as things-collaborating-with-things, we must benchmark best practice far beyond telecommunications today. Indeed, as base stations sometimes vanish into multipurpose high-rise buildings and stratospheric solar drones and as client devices vanish into wearables, implants and more, thermal management uniquely for 6G will become less common. The report finds great opportunities for new thermal materials and principles in all this. Necessarily, the report is very detailed, involving 11 chapters, 11 SWOT appraisals, 32 forecast lines 2026-2046 and 33 new infograms. Vitally, it analyses the flood of new research advances through 2025 because out-of-date reports can be very misleading in this rapidly evolving subject. Indeed, the report is continuously updated so you only get the latest.

Quick read

The 48-page Executive Summary and Conclusions is sufficient for those with limited time. See the emerging needs, 19 primary conclusions, detailed 20-year roadmaps in 6 lines and those 32 forecasts with explanation, for example. The radically new cooling technologies such as Passive Daylight Radiative Cooling PDRC, five forms of caloric cooling and wide-area thermoelectrics are introduced together with combinations. See why solid-state cooling comes to the fore. A pie chart prioritises solid-state-cooling materials in number of latest research advances, revealing some issues with toxigens, for this report is unbiassed. Parameter comparisons and forecasts of their improvement are presented.

Tougher and more varied thermal needs arriving

Chapter 2. Introduction (40 pages) explains the changing view of what 6G seeks to achieve and when and the trend to smart thermal materials to assist. From graphics, quickly absorb the severe new microchip cooling requirements arriving, cooling 6G electronic components, smartphones and 6G base stations including cooling solar panels and cladding for 6G infrastructure, and thermal management of large batteries for 6G infrastructure. There are hype curves for the thermal materials by year ahead, and a table where twelve solid-state cooling operating principles are compared by 10 capabilities. See examples of advances in 2024-5. Indeed, every chapter examines latest advances.

New approaches to cooling arriving and eagerly sought

Cooling that does not need power will be as important as self-powered infrastructure in avoiding prohibitive costs for vast 6G infrastructure everywhere. Therefore Chapter 2 covers Passive Daytime Radiative Cooling (PDRC) ejecting heat from Earth through the near-infrared window. Understand 40 important advances in 2024-5 and how ten companies are commercialising PDRC. 103 pages are needed due to the wide relevance to 6G, from enhancing its thermoelectric energy harvesting to cooling base stations and buildings. Three SWOT appraisals respectively address passive radiative cooling in general, Janus effect for thermal management and anti-Stokes thermal management.

Ferroic cooling will become important

Chapter 5. Phase Change and Particularly Caloric Cooling shows how the conventional phase changes between gas, liquid and solid have limited relevance to 6G but ferroic phase change called caloric cooling could be very valuable. Learn which forms are most promising and what research achieved through 2025. The 77 pages present pie charts, SWOT appraisals and tables pulling it all together.

Thermoelectrics reinvented

Chapter 7, in 53 pages, covers future thermoelectric cooling such as wide area versions. Thermoelectric harvesting for 6G “Zero emission devices ZED” also appears. Its cold side is becoming a user of new forms of solid-state cooling and it can power active forms of solid-state cooling, all applicable to 6G Communications. There is even analysis of new research on multifunctional cooling and multi-mode cooling, both including thermoelectrics as a part because 6G thermal management must become much more sophisticated, such are the challenges it must address.

Evaporative, melting and flow cooling

Chapter 8. takes 38 pages to cover future evaporative, melting and flow cooling including heat pipes, new thermal hydrogels for 6G client devices and infrastructure. Infograms, commentary and comparisons make sense of it all. Chapter 9 then takes 57 pages to analyse Thermal Interface Materials TIM and other emerging materials for 6G conductive cooling challenges. Then Chapter 10 (30 pages) covers advanced heat shielding, thermal insulation and new ionogels for 6G and Chapter 11 (26 pages) gives the big picture of thermal metamaterials for benchmarking into 6G. All these chapters include much 2025 research.

Unique, essential reference

This Zhar Research report, “6G Communications Thermal Materials for Infrastructure and Client Devices: Opportunities, Markets, Technology 2026-2046” is your essential up-to-date and in-depth source as you participate in the lucrative new 6G thermal materials market that is emerging. Product and system integrators and operators will also value the report.